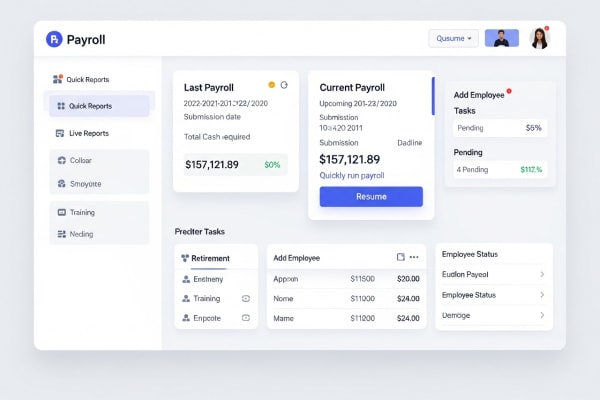

Pay your team accurately and on time

Running payroll shouldn’t take hours or cause headaches. The right payroll software makes it simple to pay employees, manage tax filings, and stay compliant, without the stress.

At Business Heroes, we compare top payroll solutions for small businesses so you can find the one that fits your team size, schedule, and budget.

How it works

Scan and Compare

Explore the top payroll providers side by side. Compare key features, pricing, and plans at a glance.

Filter to Fit

Quickly narrow down your options. Sort by business size, budget, or payroll needs.

Pick and Go

Choose your ideal payroll provider. Start a trial or sign up in just a few clicks.

Why choose Business Heroes?

Join a growing community of business owners who rely on our research to power their growth.

Meet the team

Our ‘Heroes’ are here to guide you through the tough decisions of running a business. They offer a wealth of information, from insightful articles and in-depth case studies to practical advice tailored for SMB owners.

Leeron Hoory

Tech and Finance Specialist

Anna Sonnenberg

SaaS Expert

Yoni Cohen

Managing Editor

Eden Zurek

Content Marketing Manager